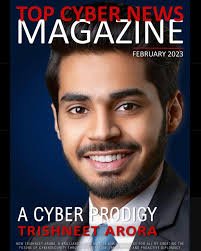

In the dynamic Indian tech scene, Trishneet Arora stands out. This young CEO, a self-proclaimed ethical hacker, carved his path not in classrooms but in the intricate world of computer code. His story is one of defying expectations and building a cybersecurity empire, TAC Security, from the ground up.

Early Affinity for Ethical Hacking

Unlike his peers glued to textbooks, Trishneet possessed an innate curiosity for technology. He delved into the complexities of computers, particularly their vulnerabilities. This fascination wasn’t destructive; Trishneet became an ethical hacker. By ethically hacking into friends’ computers (with permission!), he learned how systems could be breached and, more importantly, secured.

From Dropout to Disruptor in Cybersecurity

The traditional education system didn’t suit Trishneet’s unconventional learning style. With his parents’ support, he made a bold decision to drop out after 8th grade. This wasn’t reckless; it was a calculated leap towards pursuing his passion full-time. He started as a tech instructor, his ethical hacking skills and knowledge in high demand. This experience not only honed his expertise but also allowed him to build a strong network within the tech industry.

The Birth of TAC Security and the Kedia Connection

At just 19, armed with a seed fund from his father and fueled by a desire to make a difference, Trishneet founded TAC Security Solutions. His vision was clear: provide companies with robust cybersecurity defenses against the ever-growing threat of online attacks. TAC Security focused on vulnerability assessment and penetration testing, essentially acting as a friendly hacker to identify weaknesses before malicious actors could exploit them.

Trishneet’s Vision Catches the Eye of a Savvy Investor

Trishneet’s vision caught the eye of Vijay Kedia, a renowned investor with a knack for spotting promising startups. Impressed by Trishneet’s passion and expertise in ethical hacking and cybersecurity, Kedia invested in TAC Security in its pre-Series A round in 2016. This investment provided TAC with a much-needed boost, allowing them to expand their services and build a stronger team.

From Humble Beginnings to National Recognition and IPO Glory

The journey wasn’t easy. Convincing established companies to prioritize cybersecurity, a relatively new concept at the time, was a challenge. However, Trishneet’s persistence and expertise paid off. His early success stories, including securing a major contract with Reliance Industries, put TAC Security on the map. Trishneet’s achievements didn’t go unnoticed. He was featured in Forbes 30 Under 30 Asia list and Fortune India 40 Under 40, a testament to his disruptive approach to cybersecurity.

TAC Security’s Rise and India’s First Pure-Play Cybersecurity IPO

Taking the next big step, TAC Security, under Trishneet’s leadership, filed a DRHP (Draft Red Herring Prospectus) with NSE Emerge in early 2024. This move aimed to make TAC India’s first pure-play cybersecurity company to go public. The IPO garnered significant interest, with Kedia’s backing further bolstering investor confidence. The issue was fully subscribed on the first day, marking a significant milestone for both Trishneet and the Indian cybersecurity landscape.

A Legacy of Innovation in Indian Cybersecurity

Today, TAC Security is a thriving public company, protecting some of India’s biggest corporations and government agencies. Trishneet, still a young man at the helm, continues to be a vocal advocate for cyber awareness. His story is an inspiration to budding entrepreneurs and a reminder that innovation and passion can pave the way for success, even outside the traditional mold. With a successful IPO under his belt, Trishneet looks poised to take TAC Security to even greater heights, solidifying its position as a leader in India’s cybersecurity domain.

For IPO

https://www.nseindia.com/market-data/sme-market

TAC Infosec IPO Details

| IPO Date | March 27, 2024 to April 2, 2024 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price Band | ₹100 to ₹106 per share |

| Lot Size | 1200 Shares |

| Total Issue Size | 2,829,600 shares (aggregating up to ₹29.99 Cr) |

| Fresh Issue | 2,829,600 shares (aggregating up to ₹29.99 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 7,650,000 |

| Share holding post issue | 10,479,600 |

| Market Maker portion | 141,600 shares |